Loan software

that accelerates change.

Replace your legacy system.

Enter new markets.

Stay ahead of the competition.

Trusted by lenders

Flexibility throughout the loan lifecycle

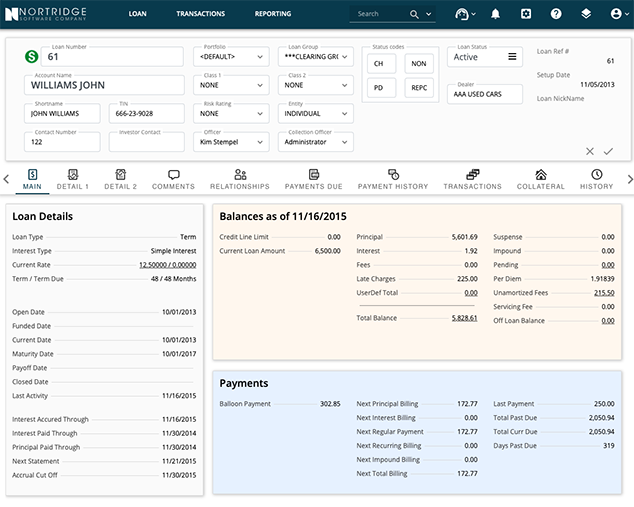

Granular configuration creating loan products and clear visibility into your loan and borrower data are just the basics.

Loan origination

Originate, underwrite, verify, and fund loans in one place. Accept applications, create loan approval workflows, run and parse credit, build rules, create and store documents.

Learn moreLoan Servicing

Accept payments online, by phone and via ACH. Generate statements and letters for online viewing or print, or email. Track and manage collateral, escrow, payoffs.

Learn moreDefault management

Improve your collection rates on delinquent accounts. Generate queues based on any triggers. Automate promises to pay, kept and broken promises. Automate handling of bankruptcies and other legal actions.

Learn moreBusiness analysis

Segment borrower and loan performance any way you want. Generate management reports for any aspect of the lending business. Direct interfaces to any GL system, export at any level of detail or summary.

Learn moreTrusted by Lenders

LiftFund

Recognized non-profit small business lender operating in 13 states. Empowers other CDFIs to originate better.

Elevate

Reinventing the non-prime lending industry by giving consumers access to responsible and transparent credit options.

Loan software that adapts to your business

The customization of NLS is great! It's stable and don't have to worry about core issues. Support has been amazing and we keep learning more about the system and it's capabilities

Kyle Stutzman

— Lithia MotorsPricing, Delivery & Features

Saas | On-premise License | Private CloudFeatures

An All-Inclusive Loan Management System

Delivery Options

Saas | On-premise License | Private CloudEnterprise pricing

Custom licensing models for high loan volume lenders

Get a customized quote that fits your lending model or lending scenario.